What is Credit Score & How to Improve it

- Kul Deep

- Last Updated on June 28, 2024

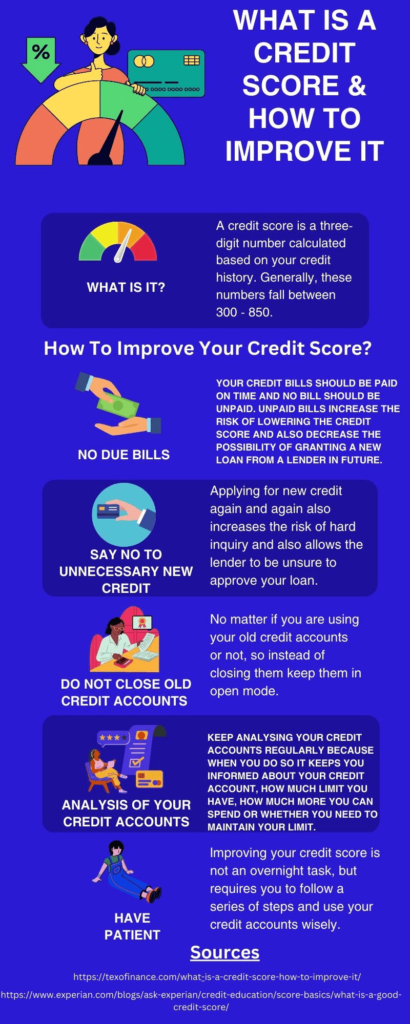

A credit score is a three-digit number calculated based on your credit history. Generally, these numbers fall between 300 – 850. The importance of credit score depends on the fact that the better your credit score is, the more likely you are able to get a loan from a financial institution. The value of your credit score also depends upon a debt or loan taken by you in the past and whether you have paid it on time. The main function of the credit score is to evaluate if you are eligible to get a loan from a lender or any financial institution. As it is said earlier, a better credit score allows you to find a good potential of receiving a loan. If your credit score is above 700 it is considered a good sign to get a loan. If you are living in Texas then you can get bad credit installment loans in Texas without any hassle.

Primary Sources of Data For Calculating Credit Scores

Payment History

Payment history includes all the payments that you have made through the banks or your accounts. It consists of the record of on-time payments or late payment data.

Length Of Credit History

Length of history is also another source of calculating credit scores. It includes the history of your oldest account.

Types of Credit Accounts

It includes those kinds of credit accounts you have. If you are carrying a mix of credit cards, mortgage, or vehicle loans.

Recent Credit Inquiries

It means that you have applied for some new credit accounts. If you are applying to take new credit then it will be calculated in the process of calculating credit score.

Before going forward, first, you should know about the FICO and VantageScore.

FICO: The Fair Isaac Corporation first began (FICO) in 1989. Though the company was founded in 1956 by Bill Fair an engineer and Earl Isaac a mathematician it came into work in 1989. It was a scoring model for lenders to check the credit history of a borrower. This is one of the greatest and most trustworthy tools for financial institutions to get a consumer’s ability to repay a loan or debt. FICO is used by most lenders and financial institutions in the US.

VantageScore: VantageScore was started by the three main credit bureaus Equifax, Experian, and TransUnion. It came into use in 2006. It is also a consumer credit scoring system which is used by different lenders and financial institutions to check the trustworthiness of eligibility for granting loans or debt.

Although both these scoring models work with the same objective, there are still some differences between them. As it has already been mentioned that both FICO and VantageScore are credit scoring models, but there was a significant difference in the credit scoring range of these two models, later with the updating of several versions of VantageScore, the scoring range of FICO and VantageScore became equal (300 to 850). In this way, the higher the score of a customer, the more likely a lender will be to give a loan to that customer. Below is a table showing the scoring ranges of FICO and VantageScore.

FICO & VantageScore Rating

| FICO Score Range | VantageScore Range |

Exceptional – Excellent | 800 to 850 | 781 to 850 |

Very Good – Good | 740 to 799 | 661 to 780 |

Good – Fair | 670 to 739 | 601 to 660 |

Fair – Poor | 580 to 669 | 500 to 600 |

Poor – Very Poor | 300 to 579 | 300 to 499 |

How Your Credit Score is Evaluated?

You will be surprised to know that there is no fixed number of credit scores and their numbers keep changing due to many reasons like the way it is calculated or the basis of credit history data collected by the company and many more. Three major credit bureaus are Equifax, Experian, and TransUnion which provide credit scores to lenders on which basis the possibility is considered to accept the borrower’s request for a loan. A customer having a high credit score makes the lender more likely to approve the loan.

How Your Credit Score Is Affected?

Your credit score is affected by some factors that can be categorised into some parts.

History Of Your Payments

Your credit history helps you a lot in getting a loan approved. Whenever you apply for a loan, the lender takes its decision only after checking your credit history. If you have a good credit history and you have made your payments on time or you have never missed an instalment then you have a positive point to get your loan approved further.

Available Credit And Used Credit

Used credit or available credit refers to how much credit you have on hand and how much you have used. Whether the credit you have used has been paid on time or not. Your credit limit and how you use it can all affect your credit score.

Length Of Your Credit History

Length of credit history means how old your accounts are and if you are an old account holder, have you been making your payments on time? All this proves that you are a responsible account holder.

Category Of Your Account

What kind of account do you have? If you are managing two types of accounts: an instalment account (e.g. car loan or personal loan) and a revolving account (e.g. a credit card). If you are able to manage both types of accounts perfectly, this also helps the lender to understand that you are good at managing different accounts at the same time. This is also called “credit mix”

New Credit

If you have opened a number of credit accounts and want to open another new one for more credit can lead you to a negative response from your lender as it will be considered to raise doubt about you for being unable to pay the loan and may increase the hard inquiries. Thus open new credit when you rightly need it.

How To Improve A Credit Score

No Due Bills

Your credit bills should be paid on time and no bill should be unpaid. Unpaid bills increase the risk of lowering the credit score and also decrease the possibility of granting a new loan from a lender in future. Regularly paid bills create a good credit history for you to have an easy debt.

Say No To Unnecessary New Credit

Applying for new credit again and again also increases the risk of hard inquiry and also allows the lender to be unsure to approve your loan. To avoid hard inquiry apply for credit only when it is in dire need.

Do Not Close Old Credit Accounts

No matter if you are using your old credit accounts or not, so instead of closing them keep them in open mode. These old credit accounts will help you to maintain your credit history.

Analysis of Your Credit Accounts

Keep analysing your credit accounts regularly because when you do so It keeps you informed about your credit account, how much limit you have, how much more you can spend or whether you need to maintain your limit.

Have Patience

Improving your credit score is not an overnight task, but requires you to follow a series of steps and use your credit accounts wisely. More than that, you have to be patient as you watch your credit score grow.

Conclusion

A good credit score is the cornerstone of financial health and it affects the ability to get a loan or a favorable interest rate. By understanding all the things and factors related to credit scores, an individual can take a step to improve this credit score. So empower yourself with knowledge to enhance your credit scores.